In the world of cryptocurrencies like Bitcoin, there’s a term that often pops up in discussions: “the halving.” But what exactly does it mean, and why does it matter? Let’s break it down in simple terms for beginners.

We’re not financial advisors.

The information in the following article does not represent financial advice. This article is for informational and educational purposes only. No person associated with STEPUP is a financial advisor or trading expert. We simply wish to present some of the information we’ve discovered after our own research in an easy to understand format. Make sure you do your own research before investing in crypto.

Imagine a digital currency like Bitcoin as a giant pie. This pie is made up of slices, and new slices are added to the pie regularly. Now, here’s the catch: unlike a regular pie that you can bake whenever you want, the slices of this digital pie are created through a process called “mining.”

Mining involves powerful computers solving complex mathematical puzzles to validate and add transactions to the blockchain, the public ledger that records all Bitcoin transactions. Miners, the people or entities running these computers, are rewarded with freshly baked slices of Bitcoin pie for their efforts.

Here’s where the halving comes into play. The creators of Bitcoin designed it to have a limited supply, much like gold or other precious metals. So, to control the rate at which new Bitcoin slices are added to the pie and prevent inflation, they implemented a rule: the reward for miners is halved periodically.

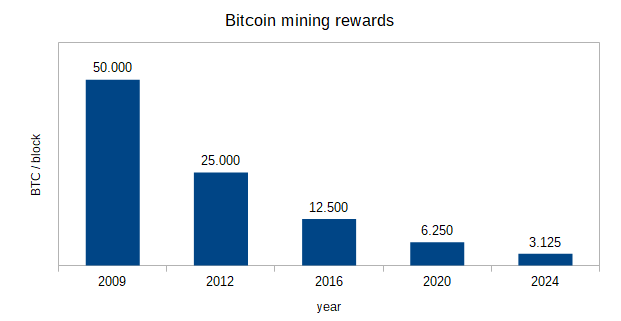

Picture this: initially, miners were rewarded with 50 slices of Bitcoin for every block (a set of transactions) they added to the blockchain. Then, after a certain number of blocks, the reward was halved to 25 slices per block. And again later, it was halved to 12.5 slices. And now, for every added block, miners receive 6.25 BTC which will become 3.125 after the halving which will be in just a few days.

Now, why does this matter? Well, when the reward is halved, it means miners receive fewer slices of Bitcoin for their mining efforts. This scarcity can have significant effects on the Bitcoin ecosystem.

Firstly, it affects supply and demand dynamics. With fewer new slices being added to the pie, Bitcoin becomes scarcer over time. Just like with any other commodity, when something becomes scarcer and in demand, its value tends to increase. This is one reason why some people believe that the halving event could cause the price of Bitcoin to rise.

Secondly, the halving affects miners directly. Imagine if you were getting paid less for doing the same amount of work. Miners need to consider whether it’s still profitable for them to continue mining after the halving. Some may shut down their operations if the cost of mining exceeds the rewards they receive.

Finally, the halving also impacts the security of the Bitcoin network. Mining plays a crucial role in securing the blockchain and validating transactions. If a significant number of miners were to stop mining due to the reduced rewards, it could potentially make the network more vulnerable to attacks.

In summary, the halving is a built-in feature of Bitcoin that reduces the rate at which new coins are created. It affects the supply and demand dynamics, miner incentives, and the security of the network. While it may seem like a technical concept, its implications are significant for the future of Bitcoin and the cryptocurrency market as a whole.

What will happen during or after the halving?

This year is the 4th halving and is expected to happen on 20th of April 2024. There will be 32 halvings in total.

Some miners may close their activity as profitability will significantly decrease. But miners who are more cost efficient (especially those with more large-scale operations) may continue to mine Bitcoin even after the halving.

Currently, it is estimated that the lowest cost to produce 1 Bitcoin is around 30.000$, but this is set to double after the halving to reach round 60.000$. Past data shows that Bitcoin almost never had a price lower than it’s lowest production cost, even though it did test those regions on occasion, especially in the days or weeks after a halving. So we might see a similar trend apply in this cycle as well.

If we look at long-term price action in previous cycles, we can see the following:

Chart source: https://www.tradingview.com/

After the 1st halving (November 28th 2012): BTC price had an around 9.200% increase in around 364 days (about a year)

After the 2nd halving (July 9th 2016): BTC price had an around 2.900% increase in around 525 days (around 1 year and a half); note that for 105 days after the halving, the price was under the level of that at the date of the halving

After the 3rd halving (May 11th 2020): BTC price had an around 600% increase in around 336 days (less than a year)

After the 4th halving (April 20th 2024): who knows…

Please note that past events may not guarantee the same trend. As you can see, the current cycle does indicate some strong differences from previous ones: the top in November 2021, FTX’s fall etc.

Time will tell what will happen with Bitcoin price after the 4th halving. One thing we can be sure of though: the Bitcoin halving is an event that affects the entire crypto market, including altcoins and memecoins such as STEPUP.